I used to hate the phrase “manage your personal finances” until I completely lost track of all my savings and expenses. I used to think, what’s there to manage? I have some right now, and I’ve worked so hard to get it to spend on myself and however I want. To all those big spenders out there, I just want to say that you did not work more than 12 hours a day and so hard just to spend it on things that matter little to you after some time. You have earned that financial and time freedom, that independence, that ability to acquire valuable things, those experiences you would want to have, and that capability to support the people you love—all those things that matter and add meaning to your life.

When I started making more money than I had expected, I lost sight of what mattered and what did not. So, I began purchasing and shelling out on stuff that merely added value to my living and contributed significantly to my overdrawn bank balance.

If you’re like me and tend to go overboard while shopping or buying things, you need to stop before you regret your impulsive purchasing decisions. After we develop a habit of spending more than we earn, it becomes really hard to stop. It takes a lot of time to focus on making the right decisions in our purchasing lists. We need to build effective practices in order to minimize our expenses and gain control over our impulsive behaviors. Doing this not only makes you a smart personal financial manager but also helps you achieve your dreams of financial freedom faster. I have attempted to include 10 major do’s to cut down expenses, which have worked really well for my personal financial management.

10 Effective Ways to Minimize Your Expenses

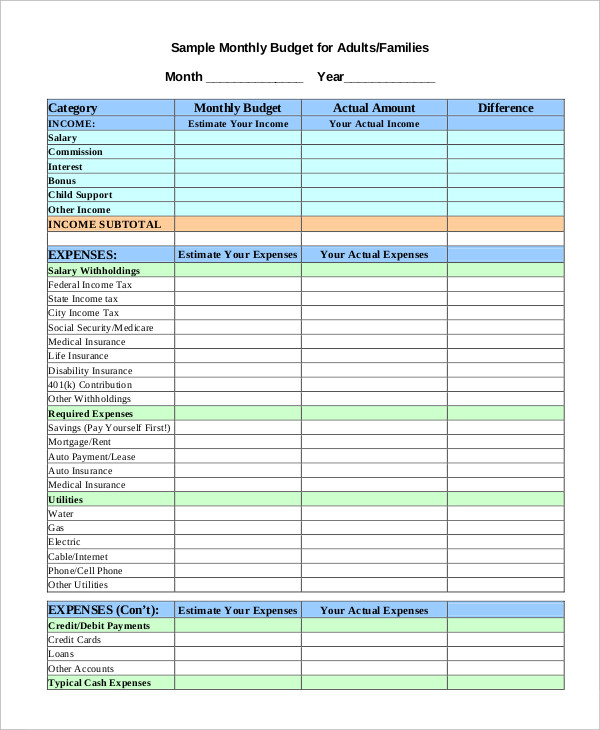

Make a Monthly Budget

Making a monthly budget helps a lot when you’re trying to cut back and track your expenditures. You should set a monthly budget lower than what you think is appropriate for you because sometimes we can go a little over budget, and that makes a huge difference. Setting it lower than your needs not only helps in cutting back but also fosters a discipline to stay at a bare minimum. When I was starting out with this method, I set my personal spending budget to Rs. 5,000, but I realized that I tended to go over it a little, which made my monthly expenses reach Rs. 6,000, and sometimes even Rs. 7,000. This almost did not work, so I needed to lower it as much as possible to Rs. 3,000. Setting my budget to the lowest helped me understand my own spending habits and be more financially restrained. So, even when I went a little over budget, it would still be under Rs. 5,000, which was my ultimate target.

If you are making a budget for yourself, set it to the bare minimum as much as possible and try your best to stay under it. It makes a huge difference in your spending habits after a while.

Follow a 30 day Rule

The 30-day rule on purchasing plays a pivotal role if you are an impulsive spender. When you feel like buying things online or in-store, don’t make the purchase the moment you see it. Instead, wait for 30 days before deciding to buy it. After 30 days, if you still feel the same urge and need to make the purchase, then you can go ahead. Until then, do nothing about it. What happens in this process is that an impulsive buyer tends to buy so quickly that they cannot see the long-term value or use of the products and services. By waiting for 30 days, you’ll have time to reflect on its purpose and how it will add meaning to your life. If it does, you will have time to weigh your options on similar products or services that will serve you just as well, if not better. However, most of the time, the things we buy impulsively do not add value, and by waiting for 30 days, we often lose interest in them altogether.

Be Clear on Needs and Wants

The important thing we should understand while cutting down our expenses is to be clear about our needs and wants. By being able to differentiate between needs and wants, we gain the ability to control our desires for things that we barely need. Needs refer to necessary products and services, while wants are just our desires, which often do not serve us purposefully. So when you feel like purchasing something, be clear beforehand if it’s a need or a want. Sometimes, wants can also be meaningful, but that doesn’t necessarily mean we have to have them right away, especially when we don’t feel like spending or are over budget. You can make the purchase after following the 30-day rule, provided it doesn’t affect your budget.

Track Your Expenses

Carry Very Less Amount

I suggest you carry a very small amount of money with you when you go out. If you’re going out with friends, bring only the necessary amount and try to stay within that. If you are shopping, eating out, or engaging in entertaining activities, you need to plan your budget beforehand. Find out how much each activity costs so you can plan accordingly. However, do not let your plan cross or hamper your overall monthly budget. If you have easy access to mobile fund transfers, make it harder to withdraw from your banking account. This teaches you a lesson in financial restraint.

Delete Unnecessary Apps

If you’re obsessed with mobile applications and in-app purchases, you need to dump them right away. I myself have been a huge impulsive in-app purchaser and, if not that, an online shopper. During the COVID lockdown, I shopped more than ever before. I used to obsess over these applications day and night and often ended up buying things in haste that I clearly never used or needed. When I realized how much I was spending and where, I had to make sure it did not happen again, so I made my mobile free of applications. I deleted all the apps from where my money was flowing out. You can do the same if you’re a huge fan of online shopping. You could also deactivate your account if the apps allow that feature. This way, you would not be able to use them even if you wanted to. Do not reinstall them no matter how hard it becomes.

Acquire a Habit of Minimalist Living Approach

Minimalistic living approach is becoming very popular these days as people are starting to realize how important it is to live free from financial stress and achieve financial freedom. This approach to living creates a habit of giving up on materialistic possessions that are merely of value in our lives. We have become so greedy these days that we have the mindset to have everything others have, and this mindset is hampering us from achieving our financial freedom. Studies have also proved that living minimally can make people happier and more relaxed. Many people are now leaning towards this lifestyle as a matter of fact. So, if you have the habit and impulse of buying everything that your friends or relatives are, you need to stop and think if you really need it. Buying fewer materials and living with the bare minimum not only saves you money, but it also frees your time from cleaning and managing stuff all around you. Start creating your life around this concept and build a sound financial habit now.

Re-Use/ Recycle

This also comes under the minimal living approach as part of it. We tend to throw away things that barely work or don’t work when they can be mended and reused. When we talk about making the most of our earnings and spending less, this is one of the significant and effective ways. If you can easily reuse your stuff—any stuff—then instead of buying brand new, mend it and start using it until you get the best out of it. On one hand, this habit will help you cut back, and on the other, it will assist you in living stress-free without having to manage new items and dump old ones. I hope we already know about the positive impacts of the reuse and recycle method on the environment as well. So, it’s a win-win situation; while you’re helping yourself manage your finances, you’re also giving something back to society, the environment, and the world overall.

Eat-in

Coming from a very personal place myself, I request you (all who are reading this out there) to spend as little as possible eating out. We have become very reckless with our eating-out habits, and we’re on the verge of forgetting the tastes and importance of our home-cooked meals. Restaurants and eateries were introduced to change our taste buds from home-cooked meals from time to time, and today it has become the opposite. Eating out has several disadvantages on our side: 1. it is very expensive to eat out, 2. sometimes you cannot avoid food allergies, 3. unhealthy foods, 4. it slowly creates a habit of spending more on food, and 5. it makes us lazy about doing our regular and important chores, like preparing our own meals. According to research studies, people spend five times more on average when they eat out. So, focus on developing a healthy habit of doing your simple home chores and saving yourself a chunk of money.

Set Different Mentality

When I say “different mentality,” I am referring to saving and spending. Today, many people seem to lose track of their money on things they don’t actually want. If we want to achieve financial freedom, we need to think and act differently than most people out there. People are showing off their brand-new material possessions on social media and the internet when we should be focusing on things that matter. Our income should be utilized on items and activities that add value or assist us in creating value. Money should not be recklessly spent on a show-off competition of who has what and how much. If you become a part of this competition, you’re never going to win, and let me tell you this: “your personal wins should be personal to you.” Read, explore, and experience how to make the most out of your hard-earned money, and learn to value its worth.

Conclusion

Following these methods, get the most value out of your money as much as possible. A saying from Brian Tracy, “Money is hard to earn and easy to lose. Guard yours with care,” could not be more relevant. These days, saving has become very challenging, yet you need to try against all odds because money can buy you freedom and the opportunity to be happy. Financial freedom can truly allow you to do what you love and are passionate about in today’s world. So, I really hope you’ll start keeping track of your expenses and manage your finances effectively.

If you have gone through personal budgeting and investing yourself, comment on how you did it and how it affected your overall finances. If you like similar posts, I’d love to incorporate more in the future. Subscribe to my newsletter if you like what I am offering here on my website.

Leave a Reply